500 STARTUPS’ PREMONEY CONFERENCE – GUEST POST

Last week Ray Walia and I had the opportunity to attend the PreMoney Conference by 500 Startups. It was one of the largest gatherings of investors and industry leaders I have ever seen. At the event Dave McClure, Founder of 500 Startups also announced they are raising $100 million for their 3rd flagship fund.

Here’s are some takeaways from PreMoney:

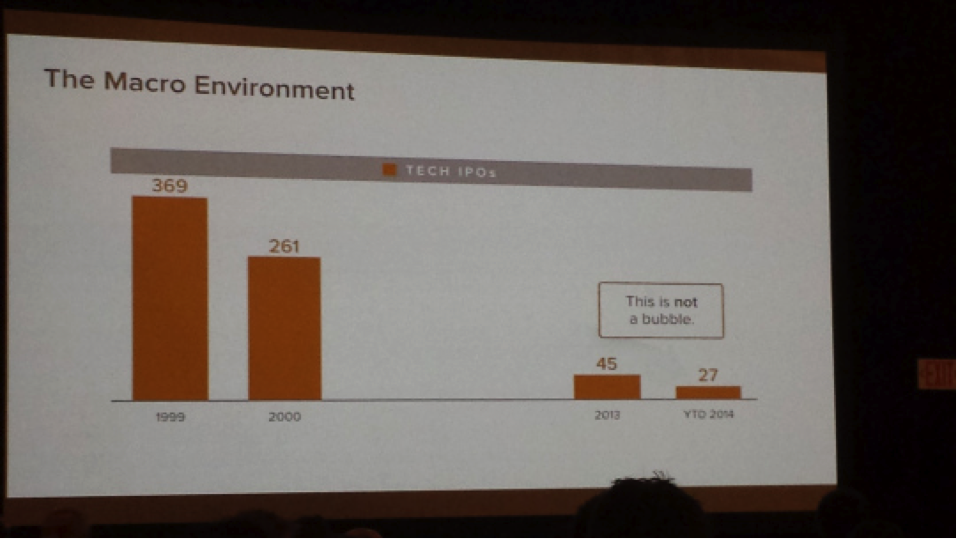

We’re not in a tech bubble yet argued Scott Kupor, Partner at Andreessen Horowitz and Mark Suster, Partner at Upfront Ventures. While it’s easy to say that by looking at the latest funding round from ride-sharing service Uber, which raised $1.2 billion at a $17 billion valuation, both Kupor and Suster laid out a series of trends showing total tech IPOs, tech IPO volume, number of tech companies raising money, and total venture money raised by tech startups down by 50% to 87% from 1999.

Because the time to IPO for tech startups has doubled from the dot-com days (from four to nine years), these companies are often already farther along in the metrics that matter for valuations. For example, the revenues of companies looking to IPO has tripled since the dot-com days, and valuations are less than half of what they were. In addition to better metrics, there are also fewer companies going public – 369 in 1999 compared to 45 last year.

Suster further explained this by stating that there are more opportunities for companies to scale today – 50x more internet users, 120x bandwidth, 10x more time online, mobile, social, global, credit-card enabled.

The startup market is bifurcating between seed investors making smaller investments in new companies and late-stage funds. According to CBInsights there are 135 micro-VCs (< $50M) now. From Nov 2013 to April 2014, almost half of the 129 funds closed were micro-VCs, while 65% were funds of $100M or less. Additionally, there is also an oversupply of accelerators and angels at the early stage.

While the accelerators, angels and Micro-VCs exude a lot of confidence, the general consensus from the LP panel discussion was that most Micro-VC pitches are largely undifferentiated. It’s usually a former entrepreneur who had some success and then did some angel investments that did moderately well and who now wants to manage a fund.

One of the important ‘value-adds’ of a Micro-VC is the ability for it to help its portfolio companies raise follow-on financing. But the data shows that startups receiving seed financing exclusively from Seed or Micro-VCs are almost half as likely to raise follow-on financing as those raising seed financing from larger VC funds.

Jeff Clavier of SoftTech VC, a leading Micro-VC funds that just closed their $85 million Fund IV had some words of wisdom for up and coming investors. Clavier started out by stating that access to good deal flow is a byproduct of success and good reputation. Be differentiated in your approach – geography, stage, sectors and industries, infrastructure, ecosystem, and value-add. For example, some of the top Micro-VCs offer value-added services from recruiting to sales and marketing support to their companies. Be explicit about your investment criteria; Clavier summarized SoftTech’s criteria as investing in smart ass teams building kick ass products for big ass markets. Keep your founders accountable by agreeing on a simple reporting schedule with a one-page template. Build strong syndicates and strong relations with VCs for follow-on investing in your portfolio. And make sure you’re using systems such as CRM, contact management, communication tools etc. to stay on top of things.

Seed is the new Series A. Paul Martino of Bullpen Capital opened his talk by saying we’re in an era of cheap – it costs a lot less to get a startup off the ground and seed-funded startups are exhibiting Series A type traction. While some argue that these days the A round is the fourth round after friends and family ($50K), pre-seed (~$500K), and seed (~$2 million), Paul considers the seed round a continuous process. The popularization of “capped convertible note,” which enables founders to accumulate money from various investors over time and then convert those investors’ holdings into equity shares down the road, has made this fast and cost-effective.

He ended with some best practices. If you’re a founder, always be raising money in the background vs. doing it periodically in the foreground. If you’re in investor, you must add specific value to help companies achieve milestones or you will be commoditized. And if you’re an LP, seed as a process means that early stage deal flow is being democratized and is frequently syndicated therefore the usual obsession about “sourcing” is less important than picking and value-add.

If you’re going to do early-stage investing, do it in a reasonable number of companies.Sam Altman of Y-Combinator has personally made 40 investments. He lost many and did well on some. Altman stated that a small percentage of your investments will drive the outcome for returns. It’s really hard to pick a good company in its early stages, so all your efforts should be towards getting awesome founders. What matters the most is the potential multiple of the investment, so angels shouldn’t have a boxed mentality where they don’t invest in startups beyond $5m or $10m in valuation. That’s where you’ll miss the next Uber.

All-in-all PreMoney provided a great opportunity to learn and network, and I look forward to attending again next year. You can check out all the slides here. The folks at 500 have been organizing some awesome events. The next one on the radar is Weapons of Mass Distribution on August 7th focusing on customer acquisition and growth. Most startups fail because they can’t get customers, so if you’re a startup founder this is an event you cannot miss. And if you’re headed to the Valley, make a few days out of it by booking meetings with investors, customers and partners. Be sure to connect with the Canadian Consulate in Silicon Valley and the C100 ahead of time.

About Lloyed

Lloyed Lobo is a partner at Boast Capital, a firm specializing in R&D Tax credits with offices in Calgary Vancouver and Silicon Valley. He is also a partner at Plug and Play Canada, a subsidiary of Silicon Valley’s Plug and Play Tech Center, an accelerator and seed-stage investor. Lloyed is very active in the tech startup community, both in Canada and the US – he is a Global Facilitator at Startup Weekend and Startup Next, board member at Startup Calgary, startup columnist at Calgary Herald, and contributor at Techvibes and Oil & Gas Magazine. Previously, Lloyed was the Head of Sales and Marketing at two venture backed software companies – TicketLeap in Philadelphia and AL Systems in New Jersey. Lloyed studied Software and Electrical Engineering at Lakehead University, Marketing at New York University, and PR Management at UCLA.