How International Startups Can Raise Funding in North America

Building a Solid Foundation in Canada for your Start-Up

Based on Fortune’s Unicorn list in 2016, 39 of the top 100 unicorns are actually based outside of the United States. A lot of these international companies are getting their funding from North American VC’s which lends the question: Should your international company be looking for US and Canadian funding and if so, why?

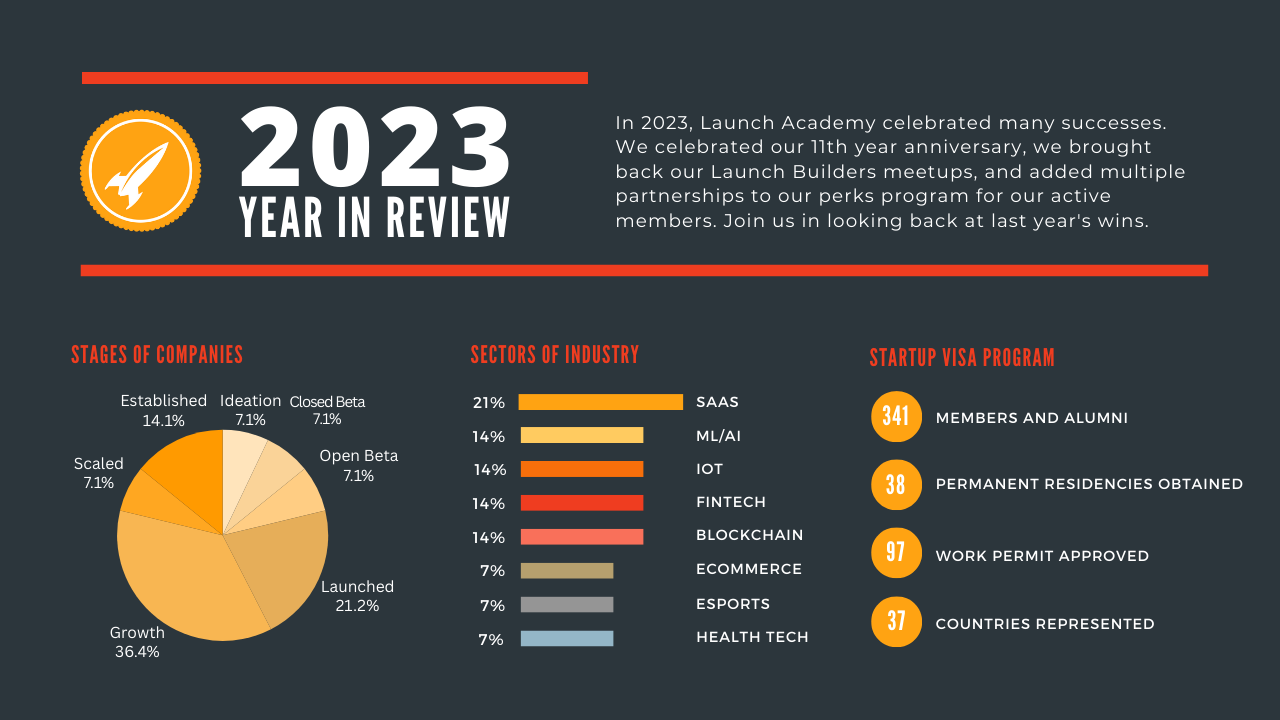

At Launch Academy I’ve worked with a lot of different international companies that have moved everything and relocated to Vancouver, Canada, mostly through our Maple Program, mentioned in our previous article. As a CEO, founder, mentor and investor myself, I’ve seen what works for entrepreneurs and what doesn’t. I’ve narrowed down the 5 things you should be considering when raising money as an international entrepreneur inside Canada and the US.

Before You Start:

Funding your company is essential, but there are so many ways to do it. Hands down the best way to fund your company is through revenues. I always say that the best investor in your business is a paying customer. But the reality is that most often companies need to raise funds through external investors in order to start and grow their business.

Before you start trying to fundraise, ask yourself: Why am I raising and why is it in North America?

A lot of the time, I’ve found that companies are raising here because they:

- Believe they can’t get access (or enough) in their home country

- Want help and mentorship from known experts

- Have aspiration of becoming a unicorn (and think North America is the only way there)

Though there is a huge pool of capital and resources in the U.S. and Canada, the rise of the technology industry globally has created so much more interest from investors around the globe, making it easier for international companies to raise at home, get help from local companies who have managed to successfully scale, and also become unicorns outside Silicon Valley (think Paytm, Flipkart, Alibaba, Didi, Spotify, and DJI).

So let’s assume you’ve considered all these factors and still want to raise in North America because your main goal is to go global. How should you do it?

Step 1: Become Legally Based in North America

To raise in Canada or the US you should start by incorporating a company in Canada or the US, and structuring it so that it either owns or controls the IP your company is building or is going to build. Effectively, you should become a US or Canadian entity that either local or foreign investors can invest in.

Why do this? Well, it comes down to the bottom line for investors; investing in foreign companies often leads to a lot of tax reporting issues and a lot of the time it’s written into investors partner agreements that the investment fund can not invest in foreign companies. Basically, it’s a lot easier for companies in Canada or the US to invest in a company that’s based here; taking down barriers to make the overall investment easier is in your best interest.

Bigger question: How can you do this?

A lot of the time, it’s up to the company to discover local resources including lawyers and tax reps, but programs like Launch Academy’s Maple Program will give companies direct meetings with the right people to streamline the whole process. Maple helps with sorting out your companies incorporation, tax implications, and transferring IP, all of which you need to consider. Our goal is to make sure you don’t spend money, but more importantly time on steps that are not necessary or not relevant to your business objectives.

When should you be doing it? If you know you want to go global, it’s always best to start this process sooner rather than later. After your company grows, along with employees and resources, the process to flip becomes a lot more complex, adding to legal fees and timelines.

Step 2: Explain Your Success Through Your Customers

After dealing with the legal stuff, you need to prep for your eventual meetings with North American Investors. One of the biggest traps companies fall prey to is spending too much time on their investor deck and not enough time constantly talking to their customers.

One of the biggest themes at Launch Academy’s last Traction Conf in Vancouver was “talk to your customers”.

C-suite executives from Intercom, TaskRabbit and Reddit all gave the same advice when talking about product-market fit. Investors need to know you’ve achieved it. At Launch Academy, one of the first things we look for when screening potential Maple Program companies is their product-market fit: what do your customers want, how can you make it, how can you deliver it effectively and is it scalable?

The scalability is probably the most important part of the equation when thinking about reaching out to US or Canadian investors. You need to be aiming for a huge market if they’re going to invest; it’s just not worth an investors time if they perceive your potential market as small.

When you’re telling your story, incorporate this customer feedback into your companies trajectory. Try and tell this story in 3 parts:

- There was this huge untapped or unsatisfied market

- The market reached a boiling point, or competition kept failing

- Your product was introduced and began to solve the problem(s)

Don’t forget to practice telling this story, since it’s key to create a narrative that not only excited investors but excites you. And just like your product, make sure to iterate when necessary. Don’t keep telling the same story if it’s not resonating with people.

Step 3: Discover your Valuation

If you’re pre-revenue, I use the term ‘discover’ a bit loosely. The fact is, your valuation is always going to be made up, a “guesstimate” if you will. You should understand the potential value of your company but don’t base that value on your revenue streams especially if you’re early-stage.

When you’re raising, base it on keeping your company afloat for the next 24 months, or long enough to achieve realistic, credible milestones. From there it really becomes a math problem. You should be able to reverse math the valuation through how much do you need to raise and how much of a stake in your company do investors want (or how much are you interested in giving up) in exchange for the funds needed.

For example, I need $1M USD for 24-months runway for my North American expansion and I’m willing to give up 10% of my company for it. So the post money valuation is $10M USD. I can back up the valuation with data and metrics around traction with existing customers, existing IP that has been developed for my home market, and projects or actual contracts with future clients and business partnerships in North America.

Now obviously each company’s situation is different and the above example is very generic. But the point is that you should be prepared to justify your valuation but also understand that other factors are involved with determining how much equity is actually exchanged for the funding. Most often investors will also look at Preferred shares and other investor rights as part of their term sheets in order to de-risk the investment on their end.

Step 4: Know the Right Investors + Be Prepared When You Meet

After doing all this prep work, the biggest issue is getting in front of the right people. Unlike casting a wide net on your potential market, you’ll need to definitely narrow down the list of investors that will be interested in your company.

If you’re an augmented reality company, you’re going to want to talk to augmented or mixed reality investors. And better yet, if you’re an international company, try to find investors looking to invest in international companies. You can see what investors are investing in on platforms like CrunchBase or AngelList — do your research.

Don’t insult potential investors by not coming prepared; you wouldn’t show up for a job interview without researching the company, so don’t show up to an investor meeting without finding out about them.

Getting that investor meeting is another story. Avoid cold emailing, people are much more open to meeting if you’ve been given an introduction. Often times the best approach is to systematically get a good network of advisors or secondary connections that are open to helping.

Finding a good initial network is exactly why programs like our Maple Program exist; entrepreneurs can tap into our networks and get direct introductions to the right people. We give our Maple companies 2 tickets to our annual Traction Conf with over 1000 C-suite executives coming up from Seattle and San Francisco, along with invites to more intimate CxO dinners taking place across North America every quarter. We accept specific tech companies at the right stage so we know they’re ready for those introductions. If you think you’re at the right stage, you can take a free assessment at launchacademy.ca/maple at any time.

Step 5: It’s All in the Close

When meeting with investors in North America, you need to be prepared with the style of meetings they’re familiar with.

- Remember your narrative. Go into the meeting avoiding assumptions and industry acronyms. Explain your company and business as concisely as possible. And make sure to include your unique selling point (USP), it will set you apart.

- Know your audience. If you’re talking to formal venture capital funds (VCs) they’ll probably have a process they need to run you through which may take weeks if not months, whereas an Angel might be ready to hand over a check at the end of the meeting (if you’re lucky!)

- Be truthful. Don’t exaggerate or bullshit. People can tell if you’re being dishonest and they will never want to invest with someone they can’t trust. If you don’t know the answer to a question they may throw at you then just be honest and tell them you don’t know but you will get back to them with the answer. Just make sure you do follow up with an answer or whatever information you may have uncovered.

When you’re done your sell, be direct in what you’re asking for. Come in with a specific ask and timeline. A good way to start off is “We’re raising our ‘X’ round and talking to investors for the next 3 weeks. Are you interested?” Create a starting point to continue the conversation.

Going back to the style of investor meetings in North America, keep in mind that business is done with trust, so agreeing to terms either in an informal email or over a handshake is still agreeing to a deal. Backing out after you’ve had a better conversation is detrimental to your reputation and word spreads fast in investor circles.

Final thoughts:

Fundraising is always an option, but it’s just that: an option.

Raising can be a full-time job, so if it’s not something that’s required to move your business forward immediately, prioritize your time and work on the tasks that are. Startups often see fundraising as a contest of “who can raise more” when it should act as a barometer of your business’s success.

Successfully raising funds is a milestone but the real work starts afterwards when you need to put those funds to work and start executing against the strategy you pitched to raise the funds in the first place and reaching the milestones the investors and your team are interested in.

![Your Complete Guide to Canada’s Startup Visa [Updated 2024]](https://www.launchacademy.ca/wp-content/uploads/2023/09/Canadas-Startup-Visa.png)